Even though freight has slowed down a little, a good portion of trucking companies are actually considering expansion according to a recent report. The typical yearend topic of discussion for most trucking companies and trucking company business owners is an upcoming bloodbath. That seems to be the case on a yearly basis. Historically during economic downturns, this has indeed been true although for the most part there have been a lot of false assumptions.

A Tale of Tales: Meet John

John launched his trucking business in 2013. His current fleet boasts 25 trucks which primarily transport frozen or chilled meat, while a freight recession looms. John hopes to have 40 trucks by the time 2023 rolls around. There is only one problem with a such goal: Everyone seems to be in the market for a big rig at the moment.

The 15 trucks that John had purchased in the spring wouldn’t be delivered this year. He might receive up to seven of these trucks at most in early 2023. Simply said, there are no open manufacturing slots. His only remaining hope is that other fleets will revoke their vehicle orders.

Cancellations are “absolutely small”, says Eric Crawford, Senior Analyst at ACT Research. This is bad news for John who has been hopeful about getting the trucks he previously ordered. After manufacturing supply chain constraints rendered during COVID-19 lockdowns, it Made it practically impossible to acquire a new truck in 2021 and much of 2022. As a result, many fleets including ones like John were heavily affected.

Current State of Truck Inventory

According to ACT, manufacturers delivered 81,000 trucks to fleets in the last three months. That is a 30% increase from the same time in 2022. Major carriers like Old Dominion anticipate spending hundreds of millions of dollars on new equipment this year. John and other small fleet owners are eager to grow their trucking companies and invest money in some additional trucks.

There has been a lot of unmet demand, according to Crawford. “There has been a severe undersupply in the industry.”

For many, the heavy demand for trucks might seem a bit shocking given the ominous headlines of a macroeconomic and freight recession. Industry insiders have warned that a trucking winter, bloodbath, or Great Purge of small trucking fleets is definitely upon us. Not just us, either! Even if a macro recession is only expected to be brief and shallow, publications like Bloomberg, CNBC, and The Wall Street Journal have all warned readers that the trucking industry is flashing danger signs (here, here, and here).

The last thing the trucking industry needs in a situation like this is tens of thousands of additional trucks. The arrival of more capacity might drive rates down even further. Especially if it coincides with a slowdown in consumer expenditures on durable goods. For both large and small fleets, this would make a freight slump even more unpleasant.

There is a less terrifying version of the current state of trucking. Normalization of the sector might also be in the near future. The trucking industry as a whole became unusually dominated by tiny fleets before, during, and after the pandemic. So, as result the increase in freight demand especially during the 2022 holiday season might in fact be handled mainly by larger fleets. Therefore creating a bit of stabilization in the trucking industry.

The Lengthy Delays In New Truck Production

One of the oddities of the supply chain turmoil of 2021 was more trucks due to consumers obsessed with durable items. Manufacturers were unable to produce and meet the demand for new trucks due to supply chain issues. According to ACT, there was a 14.7-month wait for a new truck in October 2021. While small fleets typically purchase used trucks, large fleets are the ones purchasing new inventory. As result it created a truck shortage due to high demand from larger fleets.

Large fleets, though, haven’t been the belles of the transportation for the last few years. Federal data show that fleets with 1,000 or more trucks increased by 1.2% between May 2021 and May 2022. Fleets with six or fewer trucks great by approximately 7.7% during this same time period.

Capacity and Freight Recession Concerns

The entry of more capacity into the market, whether in the form of small or large fleets, can be a potential cause of concern. The current fleets, particularly the smaller ones and owner-operators, are already having a hard time coping with the falling rates and growing costs.

According to Daniel Kao, CEO, and co-founder of load board TruckSmarter, “A lot of folks are just now obtaining their trucks and trailers.” They had made the purchase of the equipment a long time ago and due to an enormous backlog, none of that equipment arrived until very late.

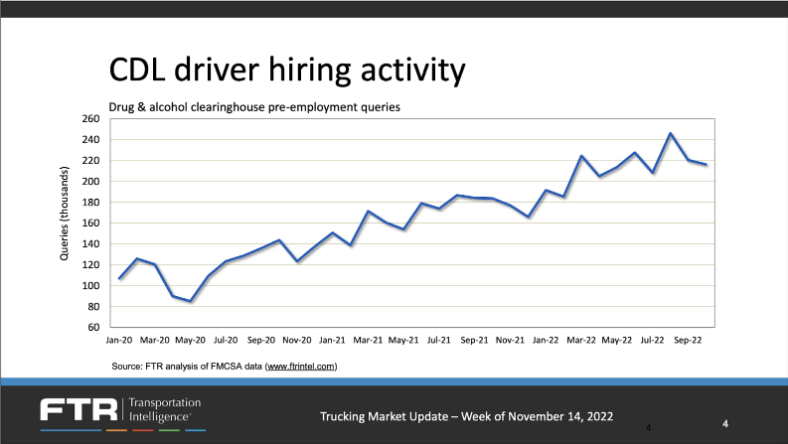

According to Avery Vise, FTR’s vice president of trucking, there has been an increase in the number of net revocations of trucking authorities this year supported by data from the federal government. The volume of pre employment questions entered into the federal Drug and Alcohol Clearinghouse that were analyzed by Vise reveals that there has been no letup in the pace of hiring activity.

This lends credence to the idea that capacity isn’t necessarily leaving the transportation industry. Rather, capacity is most likely flowing to huge fleets, as both Crawford of ACT and Chris Visser, senior analyst at J.D. Power has pointed out.

Despite the fact that more and more owner-operators are going out of business, there are still some who are breaking into the market or growing their operations. One of them is Cory Williams, who lives in the eastern part of Iowa. It was his intention to launch a trucking company in the latter half of 2021. However, due to delays in the necessary equipment to do so, he was unable to launch operations until the middle of 2022.

Williams, whose company primarily transports recreational vehicles like campers, stated, “I am not going to say that it hasn’t been difficult.” “Because I handle everything by myself, I’ve picked up a lot of useful information.” In the end, it’s going to be worth it.”

Conclusion

The current pulse of the trucking industry is a bit unpredictable. Although some might say that it’s the case year-over-year. The pandemic definitely did not help things when it came to new truck demand and the supply chain. Especially for larger fleets who were already heavily dependent on receiving new trucks to help them move the already delayed shipments.

Here’s our take on the current situation.

If you are a small to mid-size trucking company like Sugar Creek Transportation, there is definitely an opportunity for growth. The window of opportunity will not last long though given the upcoming sector stabilization. It will be driven by the supply of new trucks to bigger trucking companies and as result slowly decrease the demand for freight for small to mid-size companies. It will most likely be anywhere from three to six months before perhaps this occurs. However, by then we will be pushing into Spring 2023 and the demand for freight will once again be slowly on the rise.

Company culture, operations, customer experience, communication, and attention to detail are a few of the things we strive for vigorously at Sugar Creek Transportation. Therefore, our business continues to evolve and grow regardless of the market challenges.

Join The Sugar Creek Transportation Team

Are you a truck driver looking for a company that will not treat you like a number? Do you want to be a part of a family instead of a company that treats you like a notch on the belt? Do you have at least two years of driving experience? We are always looking for self-motivated, driven, and energetic people to join our family.

Give us a call at (909) 746-0370 or by email at recruiting@scetrans.com. Make sure to follow us on LinkedIn, Instagram, Facebook, and Twitter to stay in touch with us in real-time.