The Trucking Bloodbath. A name that has earned a staple in the trucking industry. Not a good one either. It is an indication of a recession. Something that trucking companies of all sizes cringe over at the thought of it. After the 2019 trucking bloodbath many trucking companies have been wondering if another one is due in 2022.

Yes, there is a trucking bloodbath that is unfolding. No, it will not affect every trucking company equally. Here are some thoughts and research we have performed to elaborate on the matter further.

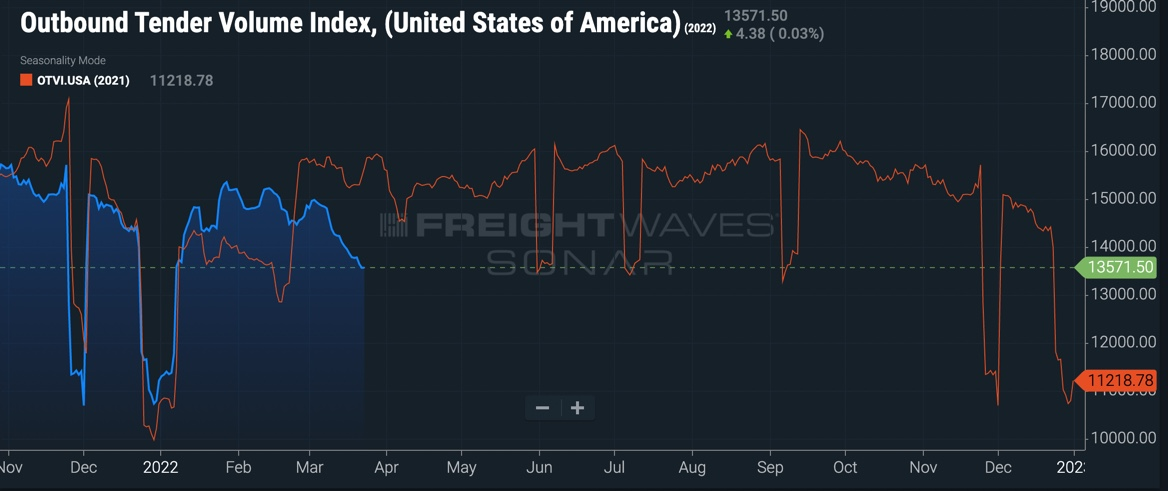

The global freight markets have been thrown into disarray by COVID over the last two years. Although, recently, volatility has begun to decrease. The image that emerges from FreightWaves’ more refined analysis of the market is not a nice one. The sonar indicates that the truckload industry is about to enter another fast and painful slump. It might quite possibly be as bad as its predecessor of 2019.

Source: FreightWaves

The Soft Truckload Volumes

A significant slowdown in consumer spending is almost certainly the cause of the reduced volumes. Consumers have become less active and as a result of inflation, skyrocketing gas prices, and Russia’s invasion of Ukraine. All of these factors together have contributed to the rise in inflation. The observations made by FreightWaves experts based on the data are being backed up by market players. Spot prices are now seeing a precipitous decline, and volumes are also decreasing.

The Modern Consumer Purchasing Behavior Has Changed

The transportation of tangible items is what we mean when we talk about freight. Because travel and entertainment do not generate a significant amount of freight, every dollar spent on “experiences” is a dollar less than may be spent on goods.

The average consumer is halting their spending after two years of unprecedented levels of purchase of material items. People are beginning to shift their spending away from physical goods and toward travel and entertainment. This change in behavior will take up a much larger percentage of people’s discretionary income than we have seen over the past two years. This shift comes as the COVID surge is largely behind us and as the economy continues to recover.

It has taken longer than many people first anticipated for the trend toward heavy spending on products to reverse itself. Evidence gathered from consumer spending reveals that a major change is taking place. The 0.3% increase in retail sales for the month of February was much lower than anticipated.

Inflation and High Fuel Prices Aren’t Helping

Consumers are on the move right now, judging by the amount of traffic, which results in an increased need for gasoline. Any money spent on filling up the gas tank will imply less money for discretionary expenditure. The exception is the 3% of the U.S. population who own EVs.

Everything is far more costly than it was in the past, and as a result, customers are beginning to become more wary about the future. Consumer confidence will suffer as a result of high gasoline costs and galloping inflation. This pattern will also inhibit consumers’ ability to make impulsive purchases.

Excessive Surplus Inventory

During the past two years, shippers experienced a lack of inventory. They ordered more than they needed in an effort to avoid a shortage. The result of that is surplus inventory. Important elements of the transshipment infrastructure, such as ports, warehouses, transloading facilities, and intermodal ramps, were congested. That slowed the velocity of freight, which in turn reduced sales and increased inventory levels.

Shippers will compensate by reducing the rate at which they buy goods and working through their existing stock when opportunities with acceptable margins present themselves.

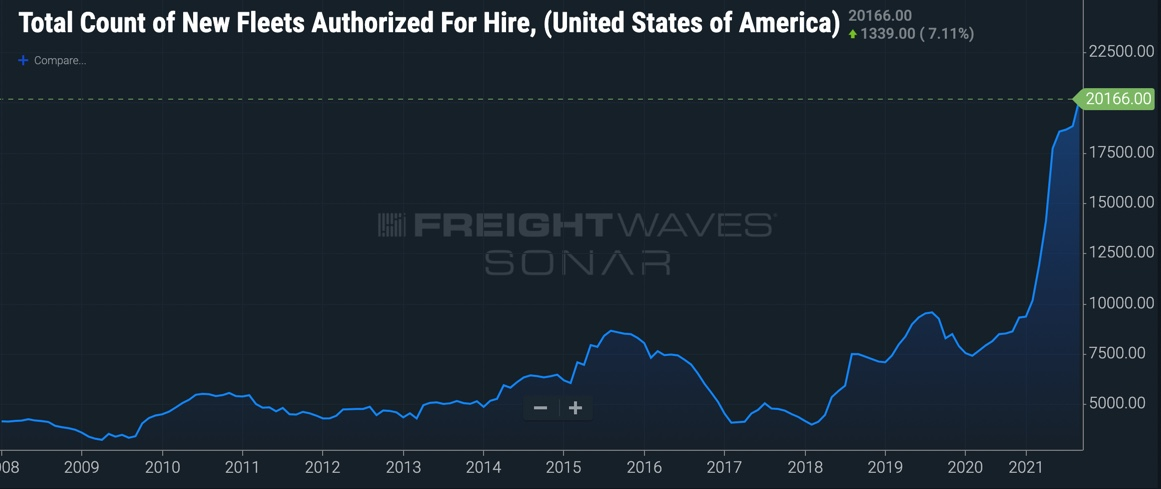

Trucking Company Bankruptcies Are Enroute

The past two years have seen the greatest number of new people in the trucking industry throughout its entire existence. There were approximately 20,166 new fleet registrations. This has never happened before. The most recent high was in August of 2019, when there were 9,511 new trucking companies. This was despite the fact that this occurred in the midst of one of the worst freight markets in the history of the world.

Because new trucking registrations often lag behind changes in market circumstances, we may anticipate that new trucking companies will continue to join the market. Even after things have become more stable. This will make the current economic crisis more severe.

Source: Freightwaves

The vast majority of newer operators are unskilled and lack prior training. It is quite doubtful that they have ever experienced a market slump. Let alone managing a trucking company during a recession. In addition, they recruited their drivers and purchased their trucks when the market was at its highest point. Definitely not a solid financial move.

These same drivers, who were seeking large spot volumes, may discover that the market offers less and fewer possibilities as time goes on. Either they will withdraw from the trucking industry entirely or move on to trucking businesses that have a more stable supply of freight. This type of behavior will leave a ton of trucks collecting dust in someone’s yard.

It is going to turn very nasty, very fast for many of these companies as a result of dropping spot rates, decreased volumes, rising fuel costs, and general inflation across the board. Back in 2019, it seemed like the trucking industry in its entirety was heading directly for a bankruptcy. This time around, that will not be quite the case.

Conclusion

The Trucking Bloodbath of 2022 continues to unfold. Many newer trucking companies will suffer because of changing consumer purchasing patterns, surplus inventory, and the lack of industry experience. The seasoned trucking companies, especially the ones who have weathered a storm or two or three will be the ones that will sustain. As they say, seasonality is gained through experience.

How bad will it get? It’s hard to tell because The Trucking Bloodbath of 2022 will affect each trucking company differently. There are too many variables and moving components.

Are you a truck driver looking for a company that will not treat you like a number? Do you want to be a part of a family instead of a company that treats you like a notch on the belt? We are always looking for self-motivated, driven, and energetic people to join our family. Reach out to us at (909) 746-0370 or by email at: recruiting@scetrans.com. You can also follow us on LinkedIn, Instagram, Facebook, and Twitter.

I have read your article carefully and I agree with you very much. This has provided a great help for my thesis writing, and I will seriously improve it. However, I don’t know much about a certain place. Can you help me?

Reading your article has greatly helped me, and I agree with you. But I still have some questions. Can you help me? I will pay attention to your answer. thank you.

Your article helped me a lot, is there any more related content? Thanks!

Your article made me suddenly realize that I am writing a thesis on gate.io. After reading your article, I have a different way of thinking, thank you. However, I still have some doubts, can you help me? Thanks.

Obrigado por compartilhar. Estou preocupado por não ter ideias criativas. É o seu artigo que me deixa cheio de esperança. Obrigado. Mas, eu tenho uma pergunta, você pode me ajudar?

Reading your article has greatly helped me, and I agree with you. But I still have some questions. Can you help me? I will pay attention to your answer. thank you.

Your article gave me a lot of inspiration, I hope you can explain your point of view in more detail, because I have some doubts, thank you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.