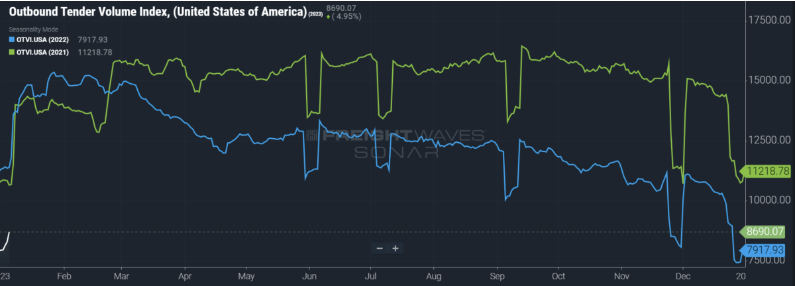

As was to be expected, freight demand dropped drastically in December 2022 due to the holidays. Neither shippers nor carriers wanted to deal with moving their goods between Christmas and New Year’s Eve. The New Year’s Day holiday falling on a Monday has kept the Outbound Tender Volume Index (OTVI), a seven-day moving average of tendered cargo volumes, at depressed levels. Although the beginning of Q1 is typically a slow and quiet period in the market, volumes are expected to recover following the holiday slump next week.

Source: Freight Waves

Week-over-week (w/w) changes in OTVI won’t tell us anything right now because of the inherent difficulties in comparing weeks with different holiday patterns. A 16.77% w/w increase in OTVI was still seen. The OTVI has decreased by 26.25% when compared to the same period last year, however year-to-year comparisons can be skewed by large variations in bid rejections. An increase in the Outbound Tender Reject Index can lead to an inflated OTVI (which includes both accepted and rejected tenders) (OTRI).

So, the real blunt question on every trucking company owner’s mind is…what is happening to the trucking industry in Q1 of 2023?

The Current State of Job Market, Freight, & Warehousing

Amazon announced it would be laying off more than 18,000 staff. Perhaps the biggest of layoffs in recent company history. A move suggesting it expects customer demand to fall. A month ago, Amazon said it would lay off 10,000 workers, so this new number is an 80% increase above that initial estimate. The company’s devices division in charge of its streaming devices, house assistant Alexa, other smart-home goods, and retail team are the most at risk from this change.

Even with the Federal Reserve’s aggressive interest rate hikes, leased warehouse space is anticipated to remain fetching a premium well into 2023. Definitely bad news for major retailers. A combination of the bullwhip effect and a decline in consumer confidence have contributed to record-low vacancy rates. However, Prologis, a major warehouse developer, predicts a 60% drop in new warehouse building starts in 2023 as a result of the Fed’s policy adjustments. Current warehousers have the incentive to keep vacancy rates low in order to justify future rate hikes.

Freight Volume Experiences an Increase

It’s a new year, and the truckload markets have roared back to life, with 115 of the 135 markets reporting weekly gains in tender volume.

Since freight demand rose in virtually all markets during the week between Christmas and New Year’s, the speed of expansion in the heavyweight regions is not particularly illuminating. Since the overall OTVI increased by 16.77% w/w, we may compare the underperforming markets to the overall rate of growth. Ontario (nearby Sugar Creek Transportation, Inc. offices and areas we serve), California’s market is just as lethargic as Atlanta’s, with a weekly increase in volume of 10.28%, and 12.1% in Atlanta.

Impact On Trucking Jobs

As it stands, trucking jobs are at a bit of a standstill. Even though freight volume has roared back to life, the demand hasn’t quite increased of huge significance in order to demand more labor to service it. Q1 of each year is typically the slowest time of the year for many carriers anyway. In part because of the holiday bounce back and also due to decrease in consumer demand. Consumer demand varies year-over-year and regardless of projections it’s difficult to specifically pinpoint.

The demand for company drivers and owner operators is expected to increase slightly as we veer into Q2 of 2023. Quite typical for an average year. Although as mentioned, it is difficult to specify the exact number of jobs that will need to be filled. Here at Sugar Creek Transportation, Inc. we are seeing this trend play out currently. Our general policy is to maintain an open rolodex of applicants interested in working with us and once the dust settles we can welcome new talent to our roster.

Unpredictable Diesel Gas Prices

The price of diesel is now in a state of flux. Damage from Winter Storm Elliott, which took the lives of several people in Buffalo, New York, and elsewhere, hampered refinery capacity and pushed the nationwide average diesel price per gallon upward for the first time in seven weeks. For consumers, the increase in gas prices due to the shutdown of refineries was probably the most noticeable effect.

However, the mild weather predicted by NOAA for the month of January is reducing the demand for diesel as a heating source and making the possibility of speedy repairs to refineries more realistic. To be sure, all-inclusive spot rates will continue to rise in tandem with diesel costs as long as they remain high.

Conclusion

Q1 of 2023 is definitely off a rocky start. Lots of different moving parts are in play but for the most part it is nothing unusual than years prior. Trucking jobs are most definitely low currently which is expected until freight demand and volume catches up in early Q2. This is largely due to the post-holiday overflow. Very similar effects we say in that last couple of years with the exception of recovery from COVID-19.

Diesel costs will be stabilizing as more and more major refineries recoup from the current surge of storms. This will vary though between the East Coast and West Coast mainly due to the supply chains. A holding pattern is really the best option for most small to midsize carriers and trucking companies. Something that we are currently experiencing ourselves.

This too shall pass and focusing on growth into 2023 is something that we personally at Sugar Creek Transportation, Inc. are primarily setting our energy on.

Join The Sugar Creek Transportation Team

Are you a truck driver looking for a company that will not treat you like a number? Do you want to be a part of a family instead of a company that treats you like a notch on the belt? Do you have at least two years driving experience? We are always looking for self-motivated, driven, and energetic people to join our family.

Give us a call at (909) 746-0370 or by email at recruiting@scetrans.com. Make sure to follow us on LinkedIn, Instagram, Facebook, and Twitter to stay in touch with us in real time.